CPA Network Lemonads: Profiting from Fintech Offers in Europe

Lemonads has carved out a solid reputation in the affiliate marketing world, particularly for its stronghold in fintech and sweepstakes campaigns across Europe. By February 2025, the network has become a key player for affiliates looking to promote premium offers in regions like France, Italy, and the DACH countries. With high payouts, advanced tracking systems, and a reputation for prompt support, Lemonads offers a lucrative opportunity for both new and seasoned affiliates.

Top-Performing Fintech Offers in France, Italy, and DACH

One of Lemonads’ biggest strengths lies in its high-converting offers tailored specifically for localised European markets. As of early 2025, top-performing campaigns include credit card signups, mobile banking apps, and investment platforms targeting younger demographics in France and Italy. These offers are backed by clear creatives and native language funnels, improving CTR and overall conversion rates.

In Germany, Austria, and Switzerland (the DACH region), Lemonads provides exclusive fintech campaigns related to crypto wallets and personal finance apps. These often come with CPL and CPA payout models, giving affiliates flexibility in revenue generation. Additionally, many of these offers are whitehat, making them sustainable for long-term promotion via compliant traffic sources like Google Ads and native networks.

What makes Lemonads stand out in these regions is its collaboration with trusted European financial brands. Affiliates benefit from user trust, which directly impacts the performance of landing pages and lowers the bounce rate. Custom pre-landers and smart links are also available to optimise mobile and desktop traffic funnels.

Strategies to Maximise Conversions in Local Markets

To achieve the best ROI, affiliates working with Lemonads in European markets should focus on localisation. This means not just translating content but adapting it to the user’s cultural and financial context. Providing testimonials, trust signals like badges, and showcasing real benefits such as zero fees or bonus rewards can significantly lift conversions.

Utilising traffic segmentation tools is another key strategy. Lemonads allows smart routing based on GEO, device, and OS — ensuring that users see the most relevant offers. Affiliates who combine this with A/B tested landing pages can fine-tune their campaigns for optimal performance in competitive fintech verticals.

Finally, incorporating email marketing and retargeting campaigns can further boost revenue. Many users in fintech niches don’t convert on the first click, making follow-up essential. Lemonads supports tracking pixels and postbacks to help affiliates manage and automate these flows effectively.

Registration, Approval Process, and Network Features

Lemonads has streamlined its onboarding process to attract a wider range of affiliates while maintaining quality. Registration typically takes under 10 minutes, with instant email verification and optional KYC for faster approvals. For new applicants, it’s important to show clarity in your traffic sources and provide past affiliate experience if possible.

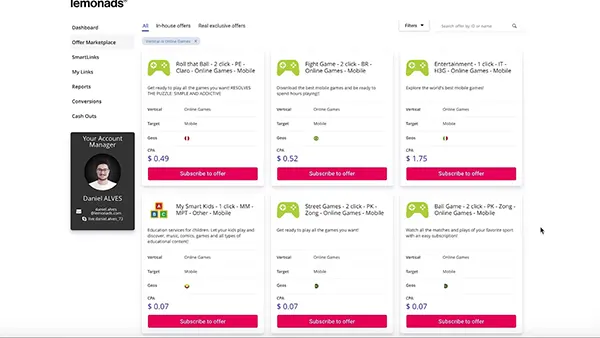

Once accepted, affiliates gain access to a personalised dashboard that includes real-time statistics, automated tracking links, and campaign filtering. The approval team is responsive and can assist in unlocking premium campaigns or tailoring creatives based on traffic type (SEO, social, display, etc.).

Lemonads also offers a tiered affiliate manager system. This means newer publishers are supported with guidance and gradual access to higher-converting and exclusive offers as they prove performance. It encourages long-term partnerships and continuous performance improvement.

Tools and Support for Affiliates

The network equips affiliates with modern tools to support campaign setup and optimisation. These include dynamic creatives, traffic estimator tools, and API integration for those running large-scale operations. There is also compatibility with all major tracking platforms like Voluum, RedTrack, and Binom.

In terms of support, Lemonads provides 24/7 access to dedicated affiliate managers via Skype, Telegram, and email. This is a major benefit for affiliates who operate in multiple time zones or need real-time changes in campaign settings.

Another valuable feature is Lemonads’ knowledge base and community webinars. These provide regular updates on trends in fintech marketing, compliance tips, and upcoming launches, allowing affiliates to stay ahead of industry changes and adjust strategies accordingly.

Fintech Verticals and Traffic Insights

Lemonads covers a wide spectrum of fintech verticals in 2025, including personal loans, buy-now-pay-later (BNPL) services, budgeting apps, insurance, and cryptocurrencies. Among these, personal loan comparison engines and mobile banking apps have shown the highest ROI in France and Germany due to consumer demand for financial flexibility.

For affiliates targeting crypto verticals, Lemonads features campaigns that comply with EU regulatory standards, which is essential for maintaining platform accounts and reducing risks. These include regulated exchange platforms, crypto credit cards, and token investment schemes that are fully KYC-compliant.

As for traffic types, Lemonads works well with push, pop, native, SEO, and social traffic. However, fintech campaigns perform especially well with high-intent search traffic and pre-qualified email lists. The combination of high-value leads and strict targeting ensures profitability even at higher click costs.

Monetisation Tactics by Case Studies

Recent affiliate case studies shared by Lemonads in Q4 2024 highlight effective monetisation tactics. For example, a campaign promoting a French neobank via TikTok influencers yielded a 6.3% conversion rate with a €32 CPL payout, thanks to native video content and strong CTA placement.

Another case in Italy involved an SEO affiliate ranking pages for “best crypto wallets 2025” and driving traffic to a regulated offer with €40 CPA. By providing value through comparative tables and FAQs, they achieved a 7% click-to-lead ratio and maintained long-term visibility.

In the DACH region, affiliates saw success using email sequences promoting credit scoring apps. Through segmented lists and pre-sell pages explaining how the apps help improve credit ratings, they secured open rates above 35% and a 4.5% overall conversion rate.